In this article, we introduce some insights into exactly whom the crypto audience is made of in an attempt to help cryptocurrency businesses discover a little bit more about the customers they are attempting to attract to their website, and ultimately, their product.

Before getting started with marketing, it is important for any type of online business to know who their target audience is. This holds especially true for crypto businesses whose customers are a special breed of audience and not as easily defined as one might immediately think. The list of marketing factors that comes in to play when attempting to connect with potential users of a crypto-related product or service is highly unique when compared to most other industries.

This is why it is a good idea for any business to know exactly who they are trying to reach before attempting to position their product or service. Below we provide some pertinent information to help cryptocurrency or blockchain-related business best accomplish this goal.

Statistics on the Demographics of Cryptocurrency Users

We start by looking at some of the basic statistical parameters to help identify a crypto-oriented target audience, including a breakdown of active users, gender, age, interests and geographic areas:

Number of active users

While over 43 million Bitcoin addresses have been created since the beginning of the world’s first cryptocurrency, it is important to use the active number of Bitcoin addresses as a better measurement of actual daily users, which currently stands at about 637,000. Of course, not all users send or receive Bitcoin every day, just as some users have multiple active addresses, and some users exclusively use other cryptocurrencies.

A meaningful monthly estimate of active cryptocurrency users in general can be found in Binance’s total number of unique users per month, which currently stands somewhere around 19 million. Interestingly, when Bitcoin’s figure of 370,000 active addresses per day is multiplied by 30 days in a month, this figure is only slightly more than 19 million.

On an annual scale, a report released in late 2018 found that at least 139 million accounts had been registered across 180 different exchanges by December of that year, even though only 38% of the accounts were considered to be active. This means that across the year, at least 52.8 million different accounts traded cryptocurrency of some sort, though it is important to take into consideration that frequently users have multiple accounts on one exchange, or one account on multiple exchanges.

Based on the figures above, it would not be grossly inaccurate to estimate the total number of people who had used cryptocurrency at least one time over the last year at a conservative minimum of 100 million, with the average number of active users per month being conservatively around 19 million.

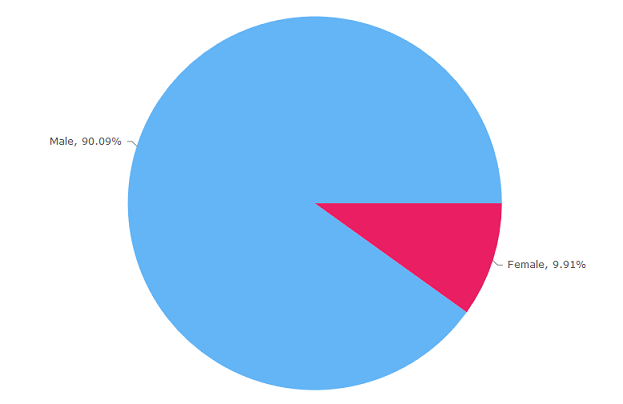

Gender

Participants in the Bitcoin community tend to be extremely lopsided in the direction of the male gender, with slightly over 90% of users reporting themselves as male in a browser-based statistical overview.

On the Bitcointalk Forum, the predominant social media forum related to all things cryptocurrency, about 82% of all users identify as male, which is at the low end for males in terms of gender-wise user distribution. In short, men by far and away compose the cryptocurrency audience of today, but don’t be surprised when the trend starts to shift closer to a balance after the mass adoption of crypto is well underway.

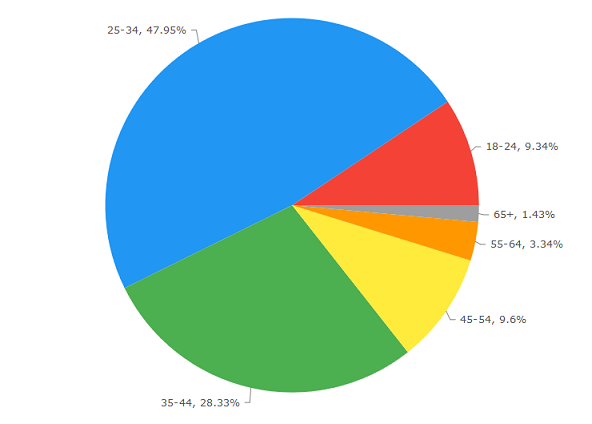

Age

The age disbursement of the Bitcoin audience is varied, but definitely youthful, with over half (57%) of Bitcoin-related website users being under the age of 34. About 38% of the audience was between the ages of 35-54, with the remaining 5% being ages 55+.

It is definitely the younger generations that are adopting cryptocurrency, with those who have experienced the internet being around through their entire lives most interested in the subject. This trend is likely to hold well into the future, as new users are coming on board every day that are perfectly comfortable with the idea of digital currency.

There is definitely something to be gained by trying to appeal to a youthful, increasingly tech savvy crowd; however, users of age 35 or over still account for 43% of the total community, meaning they should by no means be neglected. The fact remains that future generations will be all the more accepting of the idea of digitally-based financial transactions as Bitcoin and other cryptocurrencies prove themselves as being reliable, sound forms of money, and we advance even farther into our internet age.

Geography

Next to the interests of a user, geography is perhaps the most important factor when it comes to establishing an audience for any crypto-related business. First of all, it should be recognized that the legality of Bitcoin and cryptocurrency varies widely all around the world, with some countries being completely accepting of it, some countries outright banning it, and most somewhere in the middle. Here is a list of countries where Bitcoin (and other cryptocurrencies) are currently illegal, as well as their related services:

- Algeria

- Bangladesh

- Bolivia

- Ecuador

- Egypt

- Indonesia

- Morocco

- Nepal

- Pakistan

- United Arab Emirates

- Vietnam

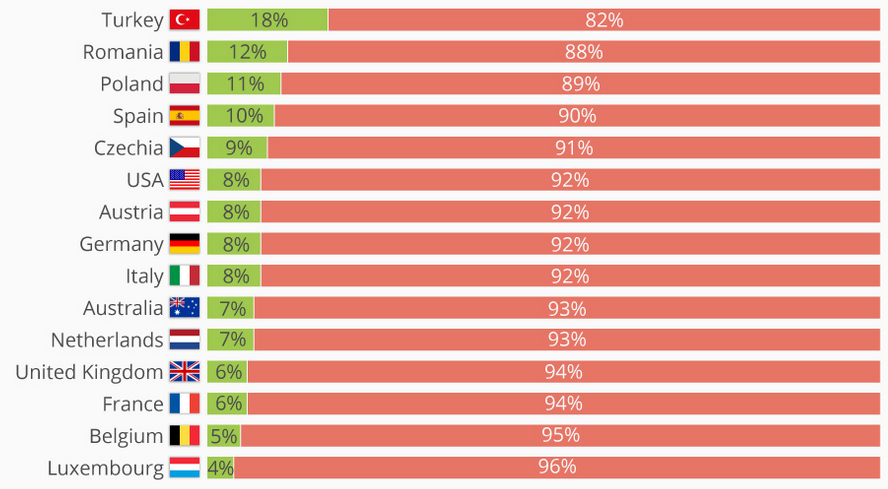

The second thing to take into consideration is that the number of people currently holding or trading cryptocurrency varies considerably from region to region. While general interest in the subject by region is a handy metric to have available, a more useful one as far as potentially making new customers is concerned is the rate of ownership by region.

An international survey conducted in 2018 found that European nations tend to report the highest rates of ownership, at an average of 9%, followed by 8% in the United States and 7% in Australia. Interestingly, the highest rate of ownership among countries surveyed was that of Turkey, with 18% of the population responding that they held at least one digital currency.

One last way to define potential geographic areas that are “hot spots” of active crypto users would be to analyze regions by total number of Bitcoin-accepting venues. For instance, this Bitcoin-related activity heat map reveals which areas of the planet have a lot of crypto acceptance as compared to others.

Interests

Knowing what other subjects cryptocurrency users are generally interested in can also help crypto-based businesses target new customers. According to a Google Analytics report of a popular Bitcoin-related website, visitors of the website tended to be most interested in a combination of financial services and software-related websites.

The top five interests of users browsing the website and the percentages of users interested in them were as follows:

- Financial Services / Investment Services: 8.14%

- Software / Design Software / Drawing & Animation Software: 3.72%

- Financial Services / Banking Services: 3.3%

- Employment: 2.76%

- Consumer Electronics / Mobile Phones: 2.7%

In terms of affinities, or dispositions of interest, the same community of Bitcoin website visitors tended to belong to the following categories by interest (the top five affinities are listed along with the percentage of visitors interested):

- Avid Investors: 7.29%

- Technophiles: 6.98%

- Shutterbugs: 6.64%

- Movie Lovers: 5.92%

- TV Lovers: 5.55%

Reasons Why People Don’t Invest in Cryptocurrencies or Blockchain-Related Products

Now that we’ve analyzed the people who do like crypto, let’s take a moment to focus on the people who don’t. Part of understanding the crypto target audience is knowing the biggest hindrances to the adoption of crypto. When designing a marketing strategy, it is important to attempt to avoid audiences who might be defined by any of the following statements:

- They find crypto hard to understand.

- They consider it to be too volatile.

- They believe their investments could lose all of their value.

- They believe all crypto to be a scam or in a bubble.

- They are under the impression it is illegal in their jurisdiction.

- They find crypto to be too difficult to spend in every-day life.

Conclusion

As a quickly generated profile of all metrics presented in this article, the typical crypto user can be described as the following: a European male, between the ages of 25 and 34, who is interested in finances, investing and technology. He is relatively risky, not overly fearful of the volatile nature of cryptocurrency, while being tech-savvy enough to understand the basic mechanics of how crypto-related products and services work.

Therefore, when building a marketing strategy, designing a product, or creating advertisements, the following aspects should be highlighted in order to maximize the potential capture of the crypto demographic:

- A website design should be heavily focused on technology while making the most that HTML has to offer.

- Advertisements, including banner and other messages should be geared toward a male audience.

- Marketing should be oriented toward an audience of millenials.

- Top geo-targeted areas should include Europe, the USA, and Australia.

While the criteria for defining a crypto audience as discussed above may seem limiting, remember that there have still only been a total of 43 million Bitcoin addresses ever created; whereas well over a billion people fall into at least two of the aforementioned categories, meaning the potential market for a crypto business or service still remains largely untapped.