The cryptocurrency industry is amazing for various reasons, and there is a plethora of interesting things you probably don’t even know about! Want to learn more and dive right in? Let’s get to it!

Bitcoin's Supply Is Limited

Those who have never heard about Bitcoin may not be aware of how it is very different from traditional money. More specifically, there is no limit as to how much money central banks can put into an economy. Whether it is physical or digital, euro, dollar, yuan, and other currencies have no supply cap. On the other hand, Bitcoin has a maximum supply of 21 million. That means there will never be more than 21 million BTC ever created, a process that will take until 2140 to complete.

The hard supply cap of Bitcoin is a bit of a rarity in the crypto world. Most currencies, including Ethereum and Dogecoin, have no finite supply to speak of. There will be a constant creation of new ETH and DOGE for years to come, although the emission rate may change over time. Having a hard supply cap makes Bitcoin scarce money, whereas Ethereum and Dogecoin have free-floating supplies.

Pak's "The Merge" Remains The Most Expensive NFT

Non-fungible tokens have made a strong mainstream impact in recent years. Collections like Bored Ape Yacht Club and CryptoPunks make headlines and note strong mainstream adoption. However, the most expensive non-fungible token to date is "The Merge" , created by Pak. A group of 28.983 collectors acquired this digital artwork for $91.8 million. The sale, conducted in late 2021, allowed buyers to purchase as many tokens as they wanted, starting at a unit price of $575.

The First Cryptocurrency Wasn't Bitcoin

One can argue Bitcoin is the first modern and decentralised cryptocurrency developed by pseudonymous coder Satoshi Nakamoto. However, the concept of a cryptocurrency dates back at least 20 years before Bitcoin, when initiatives like blinded cash and a Dutch project involving money linked to smartcards popped up. Neither of these projects survived for long, though, but they have helped pave the way for digital money as we use it today.

Other notable initiatives occurring in the 1990s include B-Money, Bit Gold, and HashCash. Developed by various individuals, these projects wanted to disrupt the current monetary system and introduce more anonymity, electronic money, and cryptography.

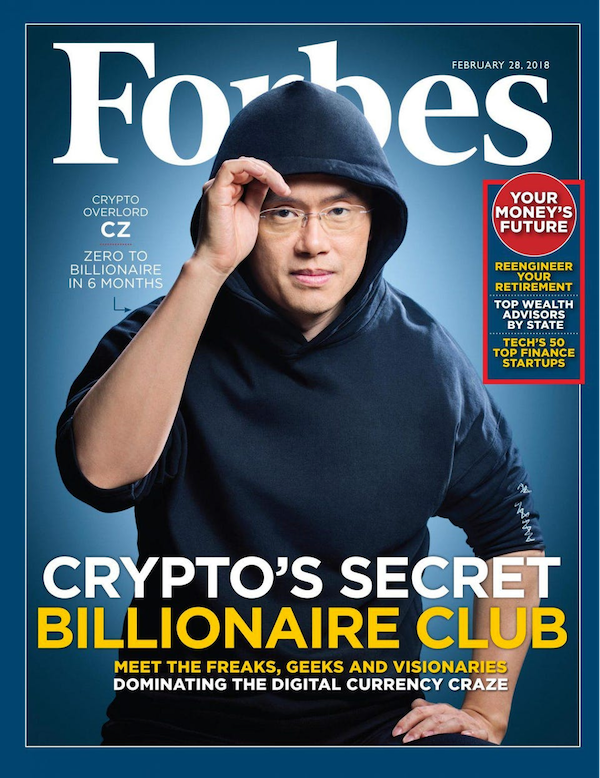

The Biggest Crypto Billionaire Is....

According to Forbes, Binance CEO Changpeng Zhao is the wealthiest individual in the cryptocurrency world. His worth is estimated at $65 billion, which he amassed in just five years. Moreover, Zhao is the 19th richest person in the world, putting him among the world's biggest billionaires. Changpeng Zhao is associated with Binance, the biggest crypto trading platform in the world, although his ownership stake in the company remains a mystery.

Zhao learned about Bitcoin in 2013 and explored various crypto projects before launching Binance in July 2017. The funding of Binance occurred through a token crowd sale, bringing in $15 million in working capital. Binance has quickly become the industry standard due to a high speed of execution and launching of various new features, products, and services.

The Landfill Bitcoin Wallet Recovery Attempt

Many people have dabbled in Bitcoin since its inception in 2019. As the currency had no immediate value until 2010 - and only gained real traction years later - people forgot about their BTC holdings from those early days. James Howells threw out a hard disk drive containing a bitcoin wallet with 7.500 BTC back in 2013. However, due to the skyrocketing value per BTC, he eventually attempted to recover the drive, which ended up in a landfill. Appeals to excavate the landfill and recover the hard drive have fallen on deaf ears so far.

The story of Howells is one of the best-known examples of people losing access to an older Bitcoin wallet. It is estimated over 3.7 million BTC has been lost over the years, meaning Bitcoin's hard supply of 21 million will not yield 21 million BTC in circulation simultaneously. Instead, the circulating supply will be closer to 17 million BTC when all bitcoins will be mined.

China Held The Crypto Momentum And Fumbled It

The topic of cryptocurrency regulation remains ever-present, even if most countries have yet to issue the official guidelines. One country taking a harsher stance toward cryptocurrency is China. The country accounted for the majority of Bitcoin trading and mining over the years yet plays almost no role of importance today. A crackdown on the domestic exchange made traders look for other platforms, including Coinbase, Kraken, Gemini, and Binance.

Not All Cryptocurrencies Are Serious Efforts

The cryptocurrency industry spans over 15,000 projects, currencies, and assets, with more added every week. While some projects have a mainstream appeal and utility, the majority of them serve no immediate or serious purposes. That said, there is a market for concepts such as "meme coins", popularised by Dogecoin and NyanCoin. In fact, Dogecoin had a substantial price surge in 2021 despite multiple years of inactive developers and no new utility or demand for the coin.

Even if a cryptocurrency is not a serious project, it should not be overlooked. While the speculative gain may be limited, these projects can still make more people acquainted with the industry. Dogecoin is an accessible currency as anyone can mine it using their computer. This situation is very different for Bitcoin, Ethereum, Litecoin, or other cryptocurrencies.

It Is Impossible To Ban Cryptocurrencies

Several governments and country officials have threatened to ban cryptocurrencies. While that sounds scary, it is also impossible to achieve. Cryptocurrencies have no management, upper echelon, or centralised servers to shut down. They will always exist as a network, although governments can curb their usage. China has made it very difficult for people to buy and use cryptocurrencies, yet there is still a market for Bitcoin and Ethereum in the region.

Physically banning cryptocurrencies would require ensuring no one can get a crypto wallet or run a network node. It is possible to achieve that goal, but it would be costly and time-consuming. Several countries, like Algeria, Bolivia, Nepal, and Cambodia, have imposed a cryptocurrency "ban". However, that primarily means no business can accept it as a payment method rather than preventing people from using the software itself.

Conclusion

There is much to learn about the cryptocurrency industry, and certain things may not be apparent at first. Many people see bitcoin and other currencies as price vehicles, yet every project has a story and history to look into. Investing in cryptocurrencies is only one option to explore, as there is much to learn and discover. The eight facts above are mere examples of things people may not know about cryptocurrencies, although there is much more to learn about.